Go to Working with Children, Young People & Families CertHE

Undergraduate

Working with Children, Young People & Families CertHE

Develop the knowledge and skills to become a front-line early help practitioner and make a…

Go to Independent & Supplementary Prescribing CPS [Level 7]

Professional

Independent & Supplementary Prescribing CPS [Level 7]

Develop the skills and competencies required to be able to prescribe medication safely,…

Go to Business & Management (Human Resource Management) BA (Hons)

Undergraduate

Business & Management (Human Resource Management) BA (Hons)

Study alongside HR professionals, gaining valuable industry insights, and benefit from CIPD…

Go to Business and Management (Entrepreneurship & Innovation) BA (Hons)

Undergraduate

Business and Management (Entrepreneurship & Innovation) BA (Hons)

Gain the skills, knowledge, and support needed to turn your business ideas into reality.

Go to Sports Performance BSc (Hons)

Undergraduate

Sports Performance BSc (Hons)

This course is your gateway to the world of high-performance sport.

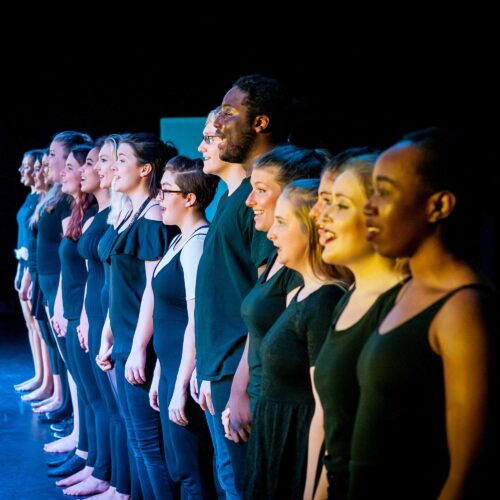

Go to Musical Theatre BA (Hons)

Undergraduate

Musical Theatre BA (Hons)

Bringing together the 'triple threat' of singing, dancing and acting you'll develop skills for a…

Go to Acting BA (Hons)

Undergraduate

Acting BA (Hons)

From classical acting to improvisation and physical theatre, you'll learn the skills for a rewarding…

Go to Education and Psychology BA (Hons)

Undergraduate

Education and Psychology BA (Hons)

Explore how psychological theory helps us understand learning, development and wellbeing within…

Go to Education, Inclusion, Special Educational Needs and Disabilities BA (Hons)

Undergraduate

Education, Inclusion, Special Educational Needs and Disabilities BA (Hons)

Benefit from our links with local schools, organisations and charities while applying your learning…

Go to Education, Digital Learning and Technology BA (Hons)

Undergraduate

Education, Digital Learning and Technology BA (Hons)

Examine how technology is transforming education in schools, colleges, universities and community…