The University Executive Committee is responsible for all matters associated with the development and management of the university.

Last updated: 5 December 2025

Members of Council and Major Council Committees

Honorary Posts, Officers and Advisers

Operating and Financial Review (incorporating the Strategic Report)

Independent Auditor’s Report to the Governing Body of the University of Gloucestershire

Financial Statements for the Year Ended 31 July 2025

| Members of Council for the period 1 August 2024 to 31 July 2025 | Membership of Major Council Committees as at 31 July 2025 |

|---|---|

| Mrs R Albrighton (appointed 13 May 2025) | Audit and Risk Committee |

| Mr B Ajibola (resigned 30 June 2025) | Mrs P Sissons * |

| Ms I Barker | Mr J Cooper |

| Mr M Burch (appointed 1 March 2025) | Ms T Harrison |

| Mr T Chambers | Ms J Walkling |

| Mr J Cooper | Mr P Tinson (co-opted member) |

| Mr P Crichard (resigned 1 July 2025) | Ms S Jary (co-opted member) |

| Ms N de Iongh (Chair) | |

| Mrs R Dooley | Finance and General Purposes Committee |

| Mr C Fung (resigned 15 May 2025) | Mrs R Dooley * |

| Mr S Gardiner | Mr M Burch |

| Miss V Garratt (resigned 30 June 2025) | Mr S Gardiner |

| Ms T Harrison (appointed 16 May 2025) | Dame C Marchant DBE |

| Miss B Holland (appointed 1 July 2025) | Dr P Warry |

| Dr L Livesey (resigned 3 December 2024) | Ms J Meekings Davis (co-opted member) |

| Dame C Marchant DBE | Mr D Oakhill (co-opted member) |

| Miss F Rowley (appointed 1 July 2025) | |

| Mrs P Sissons | Governance and Nominations Committee |

| Ms E Soros | Ms N de Iongh * |

| Mr D Soutter (resigned 31 December 2024) | Mrs R Albrighton |

| The Rt Revd R Springett (Vice-Chair) | Ms I Barker |

| Mr J Sucksmith | Dame C Marchant DBE |

| Ms J Walkling | Ms E Soros |

| Dr P Warry | Ms J Walkling |

| Prof G Layer (appointed 15 September 2025) | Mr S Gardiner (Senior Independent Governor in attendance) |

| Board Apprentice | Remuneration and Human Resources Committee |

| Ms E Hill (appointed 1 September 2024) | The Rt Revd R Springett * |

| Mr B Edington-Thomas (appointed 12 May 2025) | Ms N de Iongh |

| Mrs R Dooley | |

| Ms B Holland | |

| Mrs P Sissons | |

| Ms E Soros | |

| * denotes Chair |

| Honorary Posts | Registered Office |

|---|---|

| Chancellor Lord Michael Bichard Pro Chancellors Rt Revd R Treweek | Fullwood House Park Campus The Park Cheltenham Gloucestershire GL50 2RH |

| OFFICERS | ADVISERS |

|---|---|

| University Executive Committee Vice-Chancellor Dame C Marchant DBE Chief Financial Officer Mrs C Stallard Chief Marketing Officer Ms K Clough Chief Operating Officer Dr M Andrews Executive Dean for Research Professor Angus Pryor Executive Dean for Partnerships, Inclusion and Innovation Professor Cathia Jenainati Executive Dean for Teaching and Quality Dr Graham Parton Company Secretary Dr M Andrews | Solicitors Mills and Reeve One Centenary Way Birmingham B3 3AY Harrison Clark Rickerbys Solicitors Ellenborough House Wellington Street Cheltenham GL50 1YD Registered External Auditors Grant Thornton UK LLP 8 Finsbury Circus London EC2M 7EA Registered Internal Auditors RSM UK Risk Assurance Services LLP 10th Floor 103 Colmore Row Birmingham B3 3AG Bankers HSBC PLC 62 George White Street Cabot Circus Bristol BS1 3BA |

This report reviews the University’s activities in the year 2024-25 in the context of the challenges and risks within which the University operates, and comprises the following sections:

Section 1: Delivering our Strategic Priorities

1.1 Introduction

1.2 Student Recruitment

1.3 Outstanding Education

1.4 Student Experience

1.5 Innovation and Partnerships

1.6 Research

1.7 Our People

1.8 Future Plans and Challenges

Section 2: Public Benefit Statement

Section 3: Financial Performance

3.1 Key Financial Highlights

3.2 Review of the Year

3.3 Financial Sustainability and Key Performance Indicators

3.4 Payment of Creditors

3.5 Value for Money

3.6 Accounting Systems

3.7 Post Balance Sheet Events

Section 4: Annual Report of the Remuneration & Human Resources Committee on Senior Staff Remunerations

4.1 Introduction

4.2 Remuneration and Human Resources Committee

4.3 Approach to Senior Staff Remuneration

4.4 Remuneration of the Vice-Chancellor (Head of Institution)

4.5 Pay Ratios

4.6 Remuneration of the Executive Group

4.7 External Appointments

4.8 Expenses

Section 5: Corporate Governance

5.1 Introduction

5.2 University Council

5.3 Academic Board

5.4 Audit & Risk Committee

5.5 Other Committees of Council

5.6 Financial Responsibilities of the University’s Council

5.7 Statement of Internal Control

With a clear strategy, comprising six strategic goals, in place until 2027, the University made significant progress in all these goals during 2024-25. However, this is part of a multi-year programme of transforming the University, building on its strengths in delivering excellent student outcomes and a connected experience working with partners both locally and globally. Highlights included improvements in our graduate outcomes and NSS scores, the opening of FuturePark cyber facilities in Cheltenham, taking significant steps through estates disposals and course redesign and consolidation to offer a better student experience and stabilize our financial position, recruitment of new leadership capabilities in both research and commercial and transformation activities, introduction of a new, digitally enabled student support model, alongside improvements in our recruitment of students.

In addition, with major rises across all three of the UK’s most influential university league tables. In the Times and Sunday Times Good University Guide 2026 the University rose six places. This builds on a 22-place climb last year. In the Guardian University Guide 2026, the University achieved one of the largest national improvements, jumping 32 places to secure 68th position and recognition as the UK’s fifth biggest riser. Meanwhile, the Complete University Guide 2026 highlighted a 16-place leap, the second highest climb in the South West. Collectively, these results place the University among the fastest-rising institutions in the country. They reflect improvements across areas that matter most to students, from teaching quality, student satisfaction and staff-to-student ratios, to employability, facilities and graduate prospects. The successes have been welcomed as a testament to the commitment and dedication of staff and students.

With an ever-changing landscape both globally from an economic and social perspective as well as across the higher education sector, the strategy remains the same into 2025-26, with key delivery milestones across each of the six objectives.

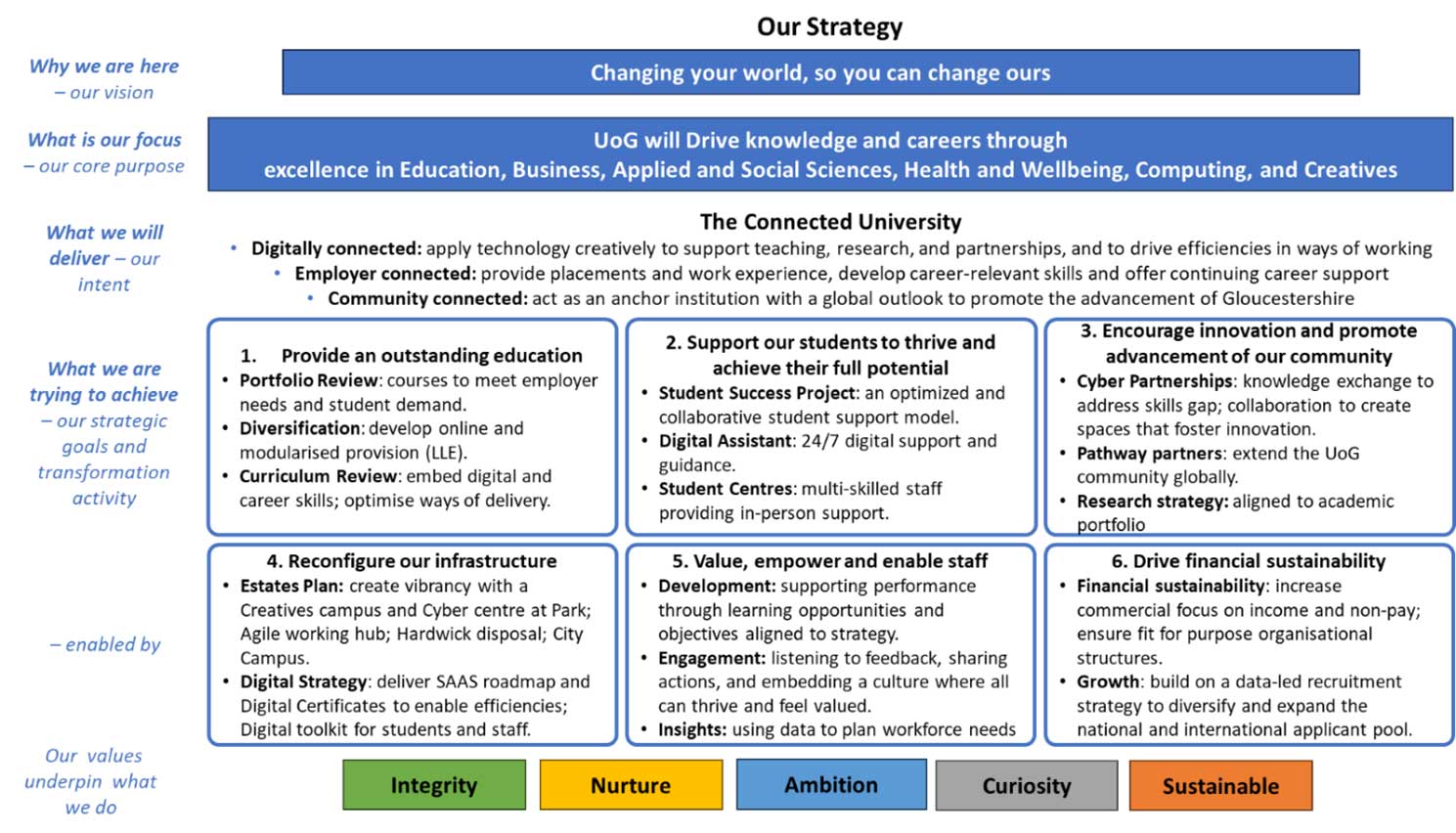

Our Strategy

Why we are here – our vision: Changing your world, so you can change ours

What is our focus – our core purpose – UoG will Drive knowledge and careers through

excellence in Education, Business, Applied and Social Sciences, Health and Wellbeing, Computing, and Creatives

What we will deliver – our intent – The Connected University

Provide an outstanding education

Support our students to thrive and achieve their full potential

Encourage innovation and promote advancement of our community

Reconfigure our infrastructure

Value, empower and enable staff

Drive financial sustainability

Our values underpin what we do: Integrity, Nurture, Ambition, Curiosity, Sustainable

The University continues to review and enhance its academic portfolio to ensure that our courses meet the aspirations of students and the evolving skills needs of employers locally, nationally, and internationally. Throughout 2024-25, we made further progress in aligning our portfolio with our strategic aims, maintaining a strong focus on professional education, applied learning, and real-world impact.

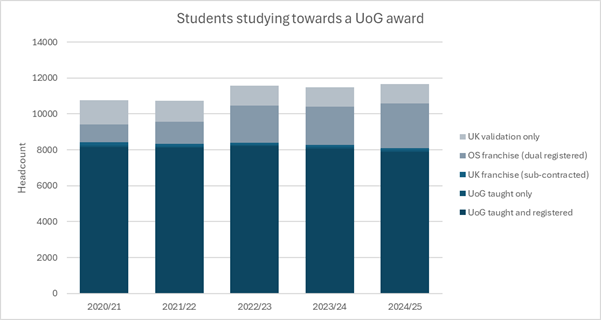

Student recruitment remained resilient in a highly competitive market, with overall enrolments steady compared with the previous year. Our apprenticeship provision once again contributed positively to our student community. While national immigration policy changes continued to influence the international student market and numbers were lower than previous year, the University successfully recruited onto a number of cohorts of overseas students, demonstrating the continued appeal of our offer and the strength of our global connections.

During the summer of 2024, we launched work to refresh the Connected University brand, engaging staff and students in exploring how our values and identity can be brought to life through communications, teaching, and community engagement.

Our partnership activity also continued to thrive. In 2024-25, we welcomed over 3,000 students studying with our overseas partners and more than 1,100 students registered on programmes validated by the University. We now work with 21 partners, both UK and International, reflecting our commitment to collaboration, innovation, and global reach.

Programme Delivery and Funding

The University successfully delivered against the Office for Students (OfS) Wave 2 programme objectives, managing a total annual funding allocation of £460,000. This was directed towards the development and delivery of the Healthcare Science Practitioner and Facilities Management Apprenticeship programmes.

Partnerships and Portfolio Performance

Partnership activity continued to expand, with a collaborative portfolio of 21 active partners. Recruitment across these partnerships exceeded expectations, achieving 106% of target, with a total of 2,791 learners enrolled. This activity generated £3.4 million in gross revenue for the reporting period.

As a silver Teaching Excellence Framework (TEF) University, we are committed to enhancing our education offer and improving outcomes for our graduates. A particular goal is to improve consistency across the student experience and outcomes across all our courses. Our Curriculum Transformation Programme, which is a multi-year initiative, kicked off early in 2024-25 to review and revise our course offer and delivery models, and to define the core curriculum frameworks that will characterise University of Gloucestershire education and our graduate attributes. The four main initial priorities for transforming our Curriculum are:

The University is comfortably above benchmark standards for the Office for Students B3 metrics: continuation, completion and progression. Action plans have been implemented for the handful of courses that are below benchmark. 94.8% of University of Gloucestershire graduates are in employment or further study 15 months after leaving university. More than 75% of University of Gloucestershire graduates secured employment classified as “highly skilled” or went into further study.

Amongst the set of highly positive results, subject groups performing particularly well include Language and Area Studies, which ranked joint top nationally; Geography and Environmental Studies and Technology, which both ranked 2nd nationally; and Law, which ranked joint 3rd. In each of these subject areas, 100% of University of Gloucestershire graduates reported being in employment or further study.

Subjects Allied to Medicine and Biological and Sports Sciences also performed well, with graduate outcomes being amongst the best in the country; 99.7% and 94.4% of graduates reported being in employment or further study, respectively.

The University continued to score above sector and benchmarks for Assessment and Feedback in the 2025 National Student Survey, and 18 courses achieved over 90% satisfaction rate for Teaching Quality. Our programmes in Animation, Television Production, Geography, Accounting and Finance, Law, Teacher Education, Sport and Exercise Science and Strength, Conditioning and Rehabilitation performed particularly well across the NSS metrics. Particularly strong subject-level performances include:

Furthermore, the BA(Hons) Photography (Editorial & Advertising) was awarded The Association of Photographers (AOP) Course of the year 2025.

Supporting our students to thrive and achieve their full potential is a core goal of our strategic plan. Following a major review in 2023/24, for 2024/25 we implemented a new approach for student support. The new service is based on our core principles:

Our new digital assistant, Nova, has transformed the way students access information and resolve queries. Available on-line through our long-established MyGlos app, it is available 24 hours a day, 7 days a week, 365 days a year. During 2024/25 it handled 36,812 student conversations and successfully resolved 97.5% of all enquiries. While Nova provides a digital front-line of support, our new Student Centres in Gloucester and Cheltenham provide a physical space for drop-in support, and act as a key gateway to other support services including Disability Services, Money Advice, and Mental Health support.

As maintenance loans have not increased in line with inflation and students continue to face difficulties in meeting their living costs, supporting students facing financial hardship remains an imperative for the University. We maintained our promise in 2024/25 of offering accommodation in university managed halls for all first-year students, including international students, and we work closely with our Students’ Union to provide financial support.

Building on our existing accommodations guarantee, our offer to students in 2024/25 included two new promises: being part of a connected UoG community and graduating job ready. We are therefore pleased to see excellent results in the latest Graduate Outcomes survey: 95% of our graduates progressed into employment or further study. The proportion of our students progressing to highly skilled employment was 78%.

During the year, the University of Gloucestershire strengthened its enterprise and innovation portfolio through a series of strategic initiatives, underpinned by external funding and national recognition. These activities continue to enhance regional economic growth, expand opportunities for students and local businesses, and support the University’s long-term financial sustainability.

Help to Grow (B2B Interactions): Successfully maintained delivery of the 90% government-funded Help to Grow: Management programme, securing two additional cohorts during the period.

UK Shared Prosperity Fund (UKSPF): Continued delivery of the UKSPF-funded SME business support programme, supporting growth for local SMEs (£106k). In April 2025, secured a further £70k allocation to expand tailored support for pre-start and early-stage enterprises in and around Gloucester city centre. This funding also underpins an awards programme providing business grants to young entrepreneurs.

FuturePark: FuturePark, the University’s flagship hub for innovation in sustainable technologies, was formally opened during the year. The development has been supported through Office for Students (OfS) capital funding of £5.8m, which has enabled the creation of new facilities designed to foster research, enterprise collaboration, and skills development. FuturePark now provides a dedicated environment for start-ups, SMEs, researchers, and students to co-locate and co-create solutions to future-facing challenges, with a particular focus on sustainability, agri-tech, and environmental innovation.

Golden Valley Skills Hub: Collaborated with partners such as the Gloucestershire County Council, GCHQ, Amazon Web Services and Gloucestershire College on the Golden Valley Skills Hub launching the initiative at the House of Commons. The Hub further strengthens the University’s role in skills development and regional workforce planning.

Small Business Charter (SBC) Accreditation: The University achieved accreditation from the Small Business Charter (SBC), awarded by the Chartered Association of Business Schools. This national recognition highlights the University’s leadership in SME support, entrepreneurship, and regional economic development. SBC status aligns directly with FuturePark and UKSPF programmes, reinforcing a joined-up approach to enterprise and innovation. It also provides access to government-backed initiatives such as Help to Grow: Management, supporting the University’s long-term financial sustainability by diversifying income streams while delivering social and economic impact.

UoG Online: The University launched two online graduate courses in partnership with Higher Ed Partners (HEP). The MBA online and the MSc Computer Science online welcome the first cohort of students in September 2025. Recruitment follows a carousel model with 6 entry points per year. The second cohort of students is planned for November 2025. Planning is now underway for the next set of courses to be launched in September 2026, namely Masters in Education online and Masters in Psychology online.

Rugby Football Union (RFU) Officiating Hub: UoG and the RFU have partnered to develop a groundbreaking programme, to discover, support and develop talented referees and assistant referees, bringing together professional rugby and football match officials.

The research leadership, and resulting structures for supporting and developing research, have been reconstituted, bringing a new focus on research excellence through ambitions for the REF and research excellence more broadly, a renewed focus on research income, and a change in research culture building on areas of previous success, whilst seeking to nurture new areas. A new structure was put in place with an overall strategic research lead, working alongside a REF lead and a new lead developing a new Graduate School, these three posts being created to replace the previous singular post of Head of Research. Underpinning this was a revised Gloucestershire Research Office, which has moved to facilitate REF preparation, institute liaison with each of the schools to capture funding and put in place support for the wider research culture.

Research funding at the University continued to grow both in quantity and quality. During this period, the University won funding from the British Academy, the EU Horizon programme, the ESRC, MRC and NERC, as well as being part of framework agreements with the Defra family of government departments, forming a partnership with a Japanese research organisation, and a framework agreement for future research with the European Commission. For the first time, the University has qualified for a UKRI block grant to support Open Access funding.

Through the year, we undertook consultations with schools about future research strategies as part of building towards the next REF (2029) and beyond, recognising that an excellent research environment takes time both to establish and to generalise. The work of this period established a new framework of leadership, the necessary underpinning structures, and ambitions, whilst continuing to extend research income and achievement.

With regards to REF preparation, all academic colleagues’ potential contributions to knowledge and understanding (CKUs) have been reviewed, including by external experts, to make an assessment of likelihood of participating effectively in the REF, as well as a consideration of contract type, with the work beginning in the summer of 2025 and looking to conclude in the autumn. As part of this process, all Units of Assessment that the University intends to submit to the REF were reviewed, to optimise those with the most significant contribution to be made, which has resulted in the beginning of a process of consolidation towards nine units, with a consolidation in the humanities. We are on track to submit a larger number of colleagues across a narrower range of units, but on average, a higher quality of contribution.

As part of nurturing and sustaining our research environment, we have taken decisive actions to allocate to those areas in the University that are most research active, working to develop an allocation mechanism that reflects contribution to research, as well as building for the next REF. Whilst we are finalising the development of that mechanism, we put in place the mechanisms for the first capacity building competition using QR funding for the academic year 2025/6. For the first time the University has won more than £5million in research funding, over a period of 5 years, triggering a change in accounting methodology as the University gains traction in funded research.

The University remains committed to investing in and supporting its staff, recognising that our people are central to delivering our strategic ambitions and creating a thriving academic and professional community.

Each year, we define a set of core people priorities to guide our efforts in workforce development, attraction, engagement, development and organisational effectiveness.

In 2024, our focus centred on several key areas:

With 2025-26 already underway, significant delivery has been seen across the six strategic goals.

Undergraduate (UG) Recruitment: New UG firm acceptances exceeded 1700 in line with projections and on track to deliver the planned 3% year-on-year growth.

Postgraduate Recruitment: Overseas postgraduate numbers increased significantly, driven by the introduction of the new Professional Masters by Research in International Business, with enrolments reaching 1,000.

City Campus opened in August 2025 ready to welcome students in September and creative subjects were relocated from Hardwick campus to Park campus, completing the development of Park as a Creative and Computing campus. Partnerships continue to be a critical part of the University’s success, with support of the Golden Valley development through the development of a skills hub prototype FutureCraft being showcased alongside partners Amazon Web Services, Gloucestershire County Council and Gloucestershire College in September 2025.

Looking forward, the team will continue to focus on our balanced scorecard and seeing improvements across the organisation – The balance scorecard tracks progress on 4 key areas Financial, Student Enrolment, Student Outcomes and People. Notable improvements have been evidenced in Student outcomes with increased retention rates for students, international student recruitment continues to grow, in particular for business-related courses. People have seen the greatest improvement across all the key performance indicators with staff churn moving towards target, absenteeism reducing and a significant increase in staff engagement and completion of the staff survey.

The University’s operating environment remains very challenging, as it does for many Universities. Student recruitment remains the key driver of sustainable financial performance, and the previous cap on regulated home tuition fees eroded the real terms value of the fee over the decade by nearly 30%.

Our key challenges relate to the need to grow our student numbers, diversify our income and control our costs. The rising 18-year-old population, which is expected to peak in 2030, provides an opportunity for the university to grow and it is good to see growth emerging in 2025-26. However, largely due to concerns around cost-of-living undergraduate recruitment remains volatile particularly in areas of provision such as nursing and education. Overseas recruitment has also been impacted in recent years by the political focus on cutting migration. In 2024-25, we have continued to focus on reducing our non-pay/supplier spend and making savings in our pay budget as further pressures are applied to this with the National Insurance increases and pay award and increment increases. We continue to focus on delivering sustained efficiency, contributing to regional economic growth and improving outcomes for students from disadvantaged backgrounds.

Going concern

Financial Sustainability is an overarching aim of the University. The Finance Strategy 2022-26 maintains this priority, with growth in turnover being at the heart of our ability to ensure sufficient surpluses and cash resources are generated to enable the University to invest in its people and infrastructure and provide an excellent student experience.

The University has adopted a rigorous self-assessment framework to assist the Council in determining whether it is appropriate to adopt the going concern basis for preparing financial statements, and, in making balanced, proportionate and clear disclosures throughout the Going Concern assessment period, which is 12 months from the date of signing the Financial Statements, to November 2026. The self-assessment includes a review of forecasts and budgets, borrowing requirements, compliance with loan agreements, timing of cash flows, contingent liabilities, supply chain risks, insurance, risk management and financial adaptability, including sensitivity analysis and stress testing. The University routinely models best, worst and probable outcomes when presenting its cash projections to Council and its sub-committees. Furthermore, the going concern reverse stress testing has considered material events that could occur even in implausible scenarios and has been used in the assessment of liquidity throughout the year, and covenant compliance at year end, the forthcoming loan refinancing is a significant matter in this regard. A Continued Viability Statement has also been developed by management and considered by Audit & Risk Committee and Council. While the University remains focussed on our mission and goals to provide an excellent experience of teaching and learning for our students, and to enable our students to achieve their full potential, we fully recognise that our ability to achieve those goals is dependent on remaining financially sustainable.

The Council approved a budget for the year to 31 July 2026 at its June 2025 meeting, taking into account the latest information on the applications cycle for Autumn 2025 and which also included consideration of the financial projections up to July 2027. In addition, the University routinely prepares an 18-month cash projection on a monthly basis which is considered by Council and Finance and General Purposes Committee. A review of recruitment performance in September against the budget targets confirms that core budget assumptions have been achieved, giving confidence in the budget. In year international recruitment has exceeded budget and evidences material growth from previous year. Cash generation and cash balances remain under pressure, although a Revolving Credit Facility is available until end December 2026, to manage pressure points which precede receipt of Student Loan Company monies three times a year. The university remains focussed on driving income generation and creating an agile cost base to ensure we remain financially sustainable.

The activity which presents greatest underlying financial risk to the university over the coming year is the successful conclusion of the loan refinancing exercise. Another less material risk relates to the disposal of a property in Cheltenham. Whilst a delay or reduced proceeds are key risks, they do not threaten financial sustainability. The final risk item relates to a VAT reclaim, which we have assumed will be settled before the end of this financial year, which gives ample allowance for delays from the expected timescale to agree the claim.

As already mentioned, the loan refinancing represents a more material risk, and positive dialogue with a number of potential lenders, including the incumbent, gives confidence in a successful outcome to the refinance exercise. The £8m RCF matures at 31 December 2026 which is just beyond the assessment period and will not be available to call upon after that date although the University could mitigate this loss. The Term Loan of £24.3m will mature in May 2027, both maturity dates are outside of the Going Concern assessment period. Should the term loan not be refinanced, it would create a threat to the financial sustainability of the University.

Mitigating actions have been identified in the event that refinance hasn’t successfully concluded prior to the RCF maturing, and these mitigating actions can be called upon if necessary. Management remains confident that the loan refinancing will conclude successfully with appropriate covenants and repayment terms and that the new loan will be entered into during the 2025-26 financial year.

After fully assessing the University projections, and considering the uncertainties described above, we believe there is a reasonable expectation that the University has adequate resources to continue in operational existence for the foreseeable future, meeting its liabilities as they fall due. For these reasons, the University continues to adopt the going concern basis in preparing the annual report and accounts.

The objectives of the University are the advancement of education in the United Kingdom for public benefit including the provision of teaching and the undertaking of research activities.

The University of Gloucestershire is incorporated as a private company limited by guarantee and is an exempt charity under the terms of the Charities Act 2011. As an exempt charity it is not required to be registered with the Charity Commission but is however subject to the Charity Commission’s regulatory powers which are monitored by the Office for Students. The University Council have due regard to the Charity Commission’s public benefit guidance. The Council have taken into account the Charity Commission’s guidance on public benefit and are satisfied that the activities of the University as described in these financial statements fully meet the public benefit requirements.

The prime beneficiaries are the students of the University of Gloucestershire who are engaged in learning, personal development and research activities. Other beneficiaries include employers, businesses, school children and the general public. Staff and students also engage in voluntary action in the local community and overseas.

We pride ourselves on being an academic community that is student-centred, learning-led and research-informed. Of particular relevance to public benefit is our commitment to widening participation and ensuring that diverse groups are supported across the whole student lifecycle and to provide opportunities for all. This commitment is captured in our published Access and Participation plan which looks to reduce and remove barriers, challenge perceptions and provide continual support to all students to ensure we are fostering, enabling and promoting equality of opportunity and outcomes at all stages of the student lifecycle: access, success (continuation and attainment) and progression.

The University works predominantly with schools and colleges, including institutions in its partnership network in Gloucestershire and neighbouring counties. It has strong strategic partnerships with further education colleges in the area, including South Gloucestershire and Stroud College and Yeovil College, and the Institute of Technology in Swindon. Interventions are in place to work with a wide range of students to ensure our intake reflects all areas of society. Such projects include residential summer schools, opportunities to access subject taster sessions and application support.

The University is committed to improving energy efficiency, reducing energy use and corresponding CO2 emissions and has again achieved First Class status in the 2024/25 People and Planet University League.

As required by relevant law and regulations, the University reports annually against the Streamlined Energy and Carbon Reporting (SECR) protocol. The data collected and analysed using the Greenhouse Gas Reporting Protocol – Corporate Standard methodology are detailed below:

| 2024/25 | 2023/24 | |

|---|---|---|

| Natural Gas consumption for on site operations (heating, catering, etc) – Scope 1 KWh | 4,536,168 | 4,641,114 |

| Fuel used for site vehicle activity – Scope 1 KWh | 21,013 | 10,562 |

| Total CO2e emissions for Scope 1 activities (fuels used on site for organisational activity) Tonnes | 835 | 815 |

| Electricity supplied from off site generation for consumption by on site operations (Heating, Ventilation, Air Conditioning, lighting, computers, etc) – Scope 2 KWh | 3,917,367 | 4,352,191 |

| Electricity generated and used on site (Photo voltaic cells) KWh | 0 | 0 |

| Total CO2e emissions for Scope 2 activities (energy generated off site and used on site for organisational activity) Tonnes | 693 | 901 |

| Total Scope 1 & 2 CO2e emissions Tonnes (for ESG target) | 1,529 | 1,716 |

| New ESG Carbon emissions target set by business April 2022 – 36% reduction in combined Scope 1 & 2 CO2e emissions from existing footprint by 2027 compared to 2018/19 emissions. | 29% reduction | 20% reduction |

| Emissions from business travel in rental cars or employee -owned vehicles where company is responsible for purchasing the fuel (Scope 3) Tonnes | 25 | 25 |

| Total CO2e emissions attributed to activity of business (Scope 1, 2 & 3) Tonnes | 1,554 | 1,741 |

| Carbon emissions target set by business: 33% reduction in Scope 1 & 32% reduction in Scope 2 CO2e emissions by 2030 compared to 2018/19 emissions (note: new target set Sep 2021) | Scope 1 = 19% reduction Scope 2 = 38% reduction | Scope 1 = 20% reduction Scope 2 = 20% reduction |

| Intensity Ratio – Tonnes CO2e emitted per 1000m2 Gross Internal Area | 17.7 | 19.5 |

Renewable energy supply:

Since 2019, the University has had a Power Purchase Agreement (PPA) which ensures that 20% of our electricity is supplied from wind farms. The University also seeks to generate electricity on site; however, our photovoltaic cells at Oxstalls and Park campuses did not generate electricity in 2024/25 due to faults. The University is investigating whether repair of these is cost-effective.

Actions taken to reduce consumption and emissions in past 12 months:

The University’s new City Campus opened in August 2025. The whole building has been modernised with new glazing, insulation, airtightness and air source heat pumps, supported by a Salix PSDS3a grant for £3,359K. The building has achieved an A-rated Energy Performance Certificate.

The sale of the Hardwick site and three buildings at the Park campus during 2025 has reduced our decarbonization liabilities by removing numerous gas boilers, non-LED lights and poorly insulated buildings.

Our LED lighting programme continues to reduce our electricity consumption. In 2024 and 2025, we replaced lighting in numerous buildings at Park through the FuturePark and Creative Campus projects. We also installed a new insulated roof on the Reynolds building as part of the enabling works for this project.

In March 2024, the University succeeded in obtaining a Salix PSDS3c grant for £690K to replace the gas boilers at Oxstalls Sports Science Building with air source heat pumps. This project will be completed in Autumn 2025 and will reduce natural gas consumption and associated greenhouse gas emissions.

Financial performance is key to ensuring that the University continues to be a successful and sustainable organisation, cash generation being a primary focus.

The University has prepared its financial statements in accordance with FRS 102 and the financial highlights are set out below.

The University reports a consolidated operating deficit for the year of £0.9m (2024: surplus of £2.1m). The reported deficit is after accounting for the FRS102 LGPS & USS (non-cash) pension credit of £2.3m (2024: £1.5m). The result, although a deterioration on prior year, reflects the controlled operational environment being managed as we navigate our way through a challenging and turbulent external market environment, driven primarily through student recruitment and fee income. Despite this contraction in income, pay costs remained stable and overall expenditure decreased.

The University continued to exceed its cash generation target of 10% and is reporting a year end ratio of 11.2% (2024: 13.4%) a decrease of 2.2%. Cash generation, liquidity and covenant compliance continues to be our primary focus in financial management.

The last five years has seen significant asset investment, with c£100m fixed asset investment over the last 5 years. Net assets have declined slightly to £93m (2024 £96m) largely driven by cash contraction.

Despite the continued and increasingly challenging external operating environment for the University and the higher education sector generally regarding capped tuition fees and cost of living crisis, satisfactory financial performance has been achieved. The investment in new facilities and estate rationalisation provides a sound footing to face future challenges.

Capital investment of £26.9m was delivered during the year, with £19.6m relating to the City Campus development. The City Campus development has been supported by several successful capital grant bids awarded in previous financial years, and additional loan finance. Capital expenditure in the year has also continued to deliver additional and upgraded space and facilities supporting the university with its estate’s rationalisation and development of its portfolio.

Fixed assets of £10.1m were disposed of during the year relating to Hardwick and Farmery and Broadlands Lodge, the disposal created a gain on disposal of £0.1m.

The FuturePark OfS funded project at The Park Campus in Cheltenham completed during Autumn 2024, with teaching commencing at the start of the year. The development includes a Cyber Control Centre, Virtual Reality facilities, a digital lounge and enhanced teaching and learning facilities. IT investment continues to support the business maintaining the core systems and infrastructure in addition to delivering significant projects to support and improve the student experience.

In July 2024, the University entered a secured facility agreement with Barclays for £42.9 million, consisting of three tranches: a term loan of £27.9m and two Revolving Credit Facilities (RCF) – one of £8m and a further RCF of £7m, with all three tranches having options to extend. The £27.9 million had been drawn to refinance the previous Barclays secured loan. The £8m RCF facility is available to help support the university minimum liquidity requirements whilst the £7m RCF facility is specifically linked to fixed asset disposals. In July 2025, the University exercised the loan extension options, with maturity dates now being: term loan May 2027; and RCF’s January 2026 and December 2026.

Our long-term borrowings (secured loans) at year end is £28.7m (2024: £32.1m).

The gearing ratio (including Service Concession) has therefore decreased to 37.2% (2024: 41.5%) and continues to sit below the target of 45% set out in the Finance Strategy.

Due to a number of material asset disposals being due to complete close to the financial year end and the potential impact any delay would have on year-end covenants amendment agreements were entered into with both lenders. In July 2025 Natwest provided a waiver in relation to the Debt Service cover ratio, Barclays also amended both the debt service cover and operational leverage ratios.

All bank covenants were therefore satisfied at year end.

Cash deposits are invested in accordance with the University’s Treasury Management Policy. The prime requirement of the policy is for capital sums to be distributed between approved financial institutions to ensure minimal risk exposure.

Deposits held with any one bank should not exceed £7m. No breeches were noted during the year. At the balance sheet date £7.4m was placed on deposit with a number of banks; average monthly balances held by deposit takers over the year were £10.3m (2024: £27.6m).

The year-end liquidity position has decreased during the year and is below the target of 75 days set out in the Finance Strategy, and at the year-end liquidity levels stood at 42 days (2024: 83 days).

Retirement benefits for employees of the University are provided by a number of defined benefit schemes. The financial results continue to include the accounting impact of FRS 102.

Under the Gloucestershire County Council Local Government Pension Scheme (LGPS) the net pension liability as at 31 July 2025 continues to be reported as £0.0m (2024: £0.0m; 2023: £0.0m), due to the scheme continuing to be fully funded and reporting a surplus of £57m an increase of £28m from prior year.

The Universities Superannuation Scheme (USS) and Church of England Funded Pension Scheme (CEFPS) are multi-employer schemes for which it is not possible to identify the assets and liabilities to the University for members and are therefore accounted for as defined contribution retirement benefit schemes. The net pension liabilities for any contractual commitment to fund past deficits have been identified within provisions: USS: £0k (2024: £0k), CEFPS: £0k (2024: £0k) due to both schemes reporting a surplus.

The Teachers’ Pension Scheme (TPS) is a multi-employer unfunded scheme and the University’s share of assets and liabilities cannot be separately identified. This scheme is therefore accounted for as a defined contribution retirement benefit scheme.

Employer contributions to pension schemes were as follows:

| Pension scheme | Current Contribution rate | 2024/25 £000 | 2023/24 £000 |

|---|---|---|---|

| LGPS | 22.10% plus £159k pa | 2,981 | 3,402 |

| USS | 14.5% | 149 | 165 |

| TPS | 28.68% | 6,066 | 5,334 |

| Defined Contribution Scheme | 10.0% | 319 | 277 |

| Others including Church of England Scheme | 39.9% (CEFPS) | 6 | 7 |

| Total | 9,522 | 9,186 |

From September 2021 all new professional services staff, except for those with continuous pensionable LGPS service are recruited through the newly incorporated subsidiary company, University of Gloucestershire Professional Services Limited (UOGPSL) and were eligible to join the new Defined Contribution Pension Scheme with Legal & General, the scheme has been awarded the Pension Quality Mark (PQM) Plus accreditation.

Management closely monitor the financial performance of the University, reporting into University Executive Committee, Finance and General Purposes Committee and Council. Swift action is taken to address any adverse movements, to ensure the University remains on a stable platform to face the current and future challenges in the HE sector.

We measure performance against the Finance Strategy targets, and our focus during 2024-25 has been on cash and cash generation. The very significant investment in City Campus in the year has depleted year end cash balances, but it is good to report cash generation has remained strong. Performance against Key Financial Indicators and bank covenants is reported to Council and relevant sub-committees. Business Planning meetings with Schools and Departments are held three times a year where performance against local targets is monitored and targets for the year ahead are agreed.

Performance against targets for the 2024-25 year is set out below:

| Key financial indicator | Performance 2024-25 | Finance strategy target 2022 to 2026 |

|---|---|---|

| Cash generation from operating activities | 11.9% | 10% of turnover |

| Operating surplus (before FRS102 pension charge) | (3.8%) | 4.5% of turnover |

| Year-end liquidity ratio (cash & investments / expenses less depreciation) | 42 days | To exceed 75 days |

| Gearing – External borrowings (all borrowings and service concessions) | 37.6% | Not to exceed 45% of turnover |

| EBITDA (before FRS102) as a % of total turnover | 5.9% | To exceed 10% of turnover |

| Investment in capital and maintenance – capital (estates, equipment and IT) – recurrent maintenance | Capital = 37% Recurrent = 1.2% | Investment as a % of turnover: 5% 1.8% |

It is the University’s policy to obtain the best terms for all its business activities and therefore terms are negotiated with individual suppliers. The University aims to pay creditors in line with its terms and conditions set out on individual purchase orders; these terms may vary by agreement or contract, or by statutory or regulatory conditions. The University paid 92.91% (2024: 96.3%) of the 8,180 invoices received within 30 days of them being determined as valid and undisputed. The average (median) payment time for invoices was 22 days (2024: 19.0 days). The University did not receive or make any payments in respect of the late payment of invoices.

The focus on value for money from all expenditure with 3rd party suppliers has been further enhanced with the creation of a centralised commercial and procurement function, this team is focusing on economy, efficiency and effectiveness in our procurement processes and ongoing commercial management of suppliers. The team are now taking a category management approach to supplier management ensuring that we identify opportunities for consolidation of contracts, improved value for money from the scope of services and contract management cadence is embedded across the University for key suppliers.

The University continues to utilise Agresso accounting software and related systems and applies regular system updates. The University is migrating to a cloud-based solution for Finance, HR and payroll systems, and a contract was entered into in May 2025 to implement a cloud-based solution for Finance during 2025-26.

The University completed on the sale of unused playing fields, known as the Folley, during October 2025. The sale proceeds for this were c£6m and this sale will be reflected within the 25/26 financial statements. There have been no other post balance sheet events.

The University is committed to transparency in Senior Staff remuneration, and the publication of this report as part of our annual financial statement is an important part of that commitment. This section is the annual report from the Remuneration and Human Resources Committee (RHRC) to Council, as required by the CUC Code.

Throughout this report ‘Senior Staff’ refers to those roles as defined in section 4.6 below. The University Executive Committee of the University includes wider members of the University outside of defined ‘Senior Staff’, including the Executive Deans of Schools as well as the People Director.

The Council adopted the Committee of University Chairs (CUC) ‘Higher Education Senior Staff Remuneration Code’ (November 2021), including the supporting documents referred to by this Code, in its approach to Senior Staff remuneration and the Remuneration and Human Resources Committee review any updated versions of this Code as they are published and amend its practices accordingly including the CUC guidance on Decisions taken about Severance Payments in HEIS (June 2018).

Council, through its Audit & Risk and Finance & General Purposes Committees, also ensures it follows the stipulations regarding Senior Staff remuneration contained in the latest publications issued by the Office for Students, including the Accounts Direction.

Remuneration and Human Resources Committee (RHRC) is the committee responsible for the development of remuneration and reward policies for Senior Staff as referred to above, together with terms and conditions of employment for such staff, and for discussion of the University’s people strategy and pay framework for all staff.

RHRC also has responsibility to Council for the oversight of pay gaps based on gender, ethnicity and other protected characteristics, as well as equal pay and other human resources matters. The Committee also receives reports on expenses claimed by Senior Staff, the register of interests, and the register of gifts and hospitality. During 2024-25 the Committee met twice but has additional meetings as required.

Council believes a single committee that combines strategic oversight with specific decision-making on senior pay, offers an aligned strategy and culture, enhanced governance and consistency of approach. The Vice-Chancellor themself is not a member of RHRC and plays no role whatsoever in establishing their own remuneration but attends for relevant agenda items including discussions concerning the performance of other members of the Executive group as well as discussions concerning the University’s overall approach to pay, conditions and the People Strategy and priorities for all staff. With a view to ensuring transparency a Student Member of Council is included in the membership of RHRC. The People Director also attends each meeting to present on relevant agenda items.

RHRC is independent, being made up exclusively of External Members of Council plus one Student Member. The membership of RHRC includes the Chair of Council. The competence of its membership is reviewed annually by Council through its Governance and Nominations Committee. This includes consideration of an individual’s expertise on appointment to RHRC as well as through the annual effectiveness review process led by the Chair of Council. The Chair of RHRC is ex officio the Vice-Chair of Council. Membership in 2024-25 was as follows:

The full Terms of Reference and Membership for RHRC (as with all Council sub-committees) may be found on the University Council webpage.

The University’s approach to Senior Staff remuneration is designed to ensure that we set pay levels for Senior Staff that are proportionate, fair, appropriate and justifiable, reflecting the skills, value, contribution and performance of the Senior Staff whilst also demonstrating value for money and the best outcomes for our students. It is also designed to attract and retain competent individuals to lead the University to achieve its strategic goals.

To ensure its approach to Senior Staff remuneration remains appropriate, RHRC periodically contributes to senior remuneration benchmarking surveys and receives reports from UCEA and other external sources which benchmarks the pay of the Senior Staff roles against sector norms.

Members of ‘Senior Staff’ are appointed on fixed basic salaries as determined by relevant benchmarking. Subject to satisfactory performance, salaries normally increase each year in accordance with the nationally determined pay award or are reviewed and determined in line with sector benchmarking to ensure we are meeting the balance between recruitment and retention, as well as value for students.

Each member of the Executive Committee (including Senior Staff) has annual performance objectives set in September which are reviewed at 6 months and 12 months respectively. The Vice Chancellor’s performance objectives and review are undertaken by Chair of Council. RHRC also receives a report on the performance of the Executive Committee from the Vice-Chancellor. In addition to these reference points, RHRC also considers the broader institutional context of the University when determining Senior Staff pay and the pay awards for all staff.

At the start of 2024, there were some changes to Executive portfolios which resulted in the creation of new roles, namely Chief Operating Officer and Chief Marketing Officer. New salaries for these positions were informed by the benchmarking information. In September 2024, it was agreed by RHRC for the other two Senior Staff members to receive the nationally agreed pay award but given the changes that took place in early 2024 regarding the Chief Operating Officer and Chief Marketing Officer, no further pay rises were awarded to the individuals in these roles. The Chief Financial Officer received a further 2.5% pay award in March 2025.

RHRC is acutely aware of the Vice Chancellors critical role in achieving the University’s strategic objectives in an increasingly financially unstable and competitive environment and they keep any review of the Vice Chancellor remuneration under close review.

The Vice Chancellor did not receive a pay increase in the 2024-25 financial year and their salary remained at £200,000 (excluding employer pension contributions of £29,000)

The Council’s normal approach is that each year the Vice-Chancellor agrees with the Chair of Council a set of performance objectives and targets for the year. At the end of each year, the Vice-Chancellor’s performance is assessed against those objectives and targets and their performance is reviewed by the Chair of Council. The Chair provides a summary of that review to RHRC for discussion in the absence of the Vice-Chancellor. A recommendation on remuneration is then made to Council for approval, reflecting judgements by the Chair and the Committee of the Vice-Chancellor’s performance against the objectives and targets, and taking account of the University’s wider operating environment, the consequent level of challenge in the role, and the University’s position in the higher education sector. On this basis, the University’s Council can be confident that the Vice-Chancellor’s remuneration package was appropriate.

The Vice-Chancellor is not provided by the University with any accommodation or a car. The emoluments of the Vice-Chancellor are provided in Note 8 of the financial statements.

The University calculates pay ratios according to the guidance issued by the Universities and Colleges Employers Association (UCEA). The methodology is informed by multiple pay reporting requirements in the public sector which were implemented following the Hutton Review of Fair Pay in the Public Sector (2011).

The pay ratio in 2024-25 between the total annualised pay of the Vice-Chancellor and the median full-time equivalent of the University Group workforce was 4.50. In 2023-24 the ratio was 4.33.

RHRC has delegated authority from Council to approve the remuneration, terms and conditions of employment and all other benefits of all Senior Staff (with the exception of the Vice-Chancellor). As referenced in the University’s articles, Senior Staff are defined as the Vice-Chancellor, the Deputy and Pro Vice-Chancellors, the Secretary, the Chaplain and the holders of such other senior posts as the Council shall from time to time determine as provided by these Articles. The other members of Senior Staff during 2024-25 (excluding the Vice-Chancellor) were as follows:

There is a robust and consistent process for setting objectives and assessing each member of Senior Staff’s contribution to the performance of the University and the achievement of its strategic objectives. No individual, including the Vice-Chancellor, is involved in deciding their own remuneration, including any discretionary performance-related element if applicable.

The table in Note 7 of the financial statements provides information concerning the number of staff with a basic salary of over £100,000 per annum, broken down into bands of £5,000. This table includes staff members who are not Senior Staff.

The University’s standard contract of employment confirms that all staff on full-time contracts (including Senior Staff) are required to devote their full time, attention and abilities to their duties during their working hours and to act in the best interests of the University at all times. Accordingly, all staff must not, without the written consent of the University, undertake any employment or engagement that might interfere with the performance of their duties or conflict with the interests of the University.

Every staff member is therefore required to notify their manager of any employment or engagement which they intend to undertake whilst in the employment of the University. The manager (including the Chair of Council in the case of the Vice-Chancellor) will then confirm whether the employment or engagement is permissible.

The University’s position on these matters for Senior Staff, including on the retention of income derived from external activities, is described in the Policy for Senior Staff on External Activities.

The University has a single published scheme for expenses that applies to all staff. View the University Staff Expenses Policy. RHRC receives an annual assurance that the scheme is operating effectively.

The University is incorporated as a private company limited by guarantee and is an exempt charity under the terms of the Charities Act 2011. Its objects, powers and framework of governance are set out in the Articles of Association, as approved by the University Council on 11 May 2021. The Articles set out the requirements, and define the responsibilities of Council and Academic Board, alongside the responsibilities of the Vice-Chancellor and Senior Staff. The University conducts its business in accordance with the seven principles identified by the Committee on Standards in Public Life (selflessness, integrity, objectivity, accountability, openness, honesty and leadership). The University’s Council has adopted the Committee of University Chairs’ (CUC) Higher Education Code of Governance (2020). The University, and its Council, is committed to best practice in all aspects of corporate governance and operates in line with the public interest governance principles as articulated by the Office for Students (OfS) in the ‘Regulatory framework for higher education in England’.

Council is the governing body of the University, responsible for setting the general strategic direction of the institution, for ensuring proper accountability, and for the strategic oversight of its finances, property and investments and the general business of the University. Council has a membership of 20: a majority of whom are non-executive and independent, together with student and staff representatives (both academic and non-academic) and the Vice-Chancellor. Members of Council are only appointed after demonstration that they satisfy the definition of ‘fit and proper persons’ as articulated by the OfS in the ‘Regulatory framework for higher education in England’.

The roles of Chair and Vice-Chair of Council are separated from the role of the University’s Chief Executive, the Vice- Chancellor. The responsibilities specifically reserved to the Council are set out in the Articles of Association of the University and further elaborated in the Statement of Primary Responsibilities and Scheme of Delegation.

In the conduct of its formal business, in addition to an annual strategic away day, the Council meets five times a year. The Council recognises that, in accordance with best practice recommended in the CUC Higher Education Code of Governance, regular reviews of the effectiveness of the Governing Body should be undertaken, and in June 2024 initiated its latest external review of governance arrangements. The draft governance effectiveness review report, prepared by GGI, was reported to Council at its November 2024 meeting. The headlines were reported as:

The GGI report set out 15 recommendations, and Council approved an action plan for implementation of actions to address the matters raised. The report has been published on the University website and is publicly available.

Council and external stakeholders should be assured that the University is compliant with the regulatory requirements and that in all its essentials the University is well governed and effectively led.

The formally constituted committees of Council are Audit and Risk Committee, Finance and General Purposes Committee, Governance and Nominations Committee, Remuneration and Human Resources Committee, and the Council, Foundation, and Chaplaincy Committee. The Scheme of Delegations further details the specific delegated powers of these committees. All these documents may be found on the University Council webpage.

The Academic Board is the academic authority of the University and draws its membership from the staff and students of the University. Its principal role is to direct and regulate the teaching and learning and research work of the University and to advise Council accordingly. The Academic Board and Council hold an annual joint meeting. The Vice-Chancellor is Chair of the Academic Board. A member of Council is appointed from amongst the members of Academic Board, and the Member of Academic Staff elected to Council is also ex officio a member of Academic Board.

Audit and Risk Committee has responsibility for monitoring the effectiveness of the University’s risk management, control and governance arrangements, along with the arrangements to promote economy, efficiency and effectiveness throughout the institution, and advises the Council accordingly. The Committee exercises oversight over internal audit arrangements, including recommending the appointment of internal auditors. It considers internal audit reports and recommendations for the improvement of the University’s systems of internal control, together with management’s responses and implementation plans. The Committee also exercises oversight over external audit arrangements, such as the nature, scope and effectiveness of the process, and considers the audit aspects of the institution’s financial statements. It also advises the Council on the appointment of external auditors. In accordance with recommended practice, the Committee, which met four times during the year, provides the opportunity at each meeting for members to meet with the internal and/or external auditors without officers of the University present.

The Strategic Risks as identified and managed closely by the University Leadership Group, with oversight from the Audit and Risk Committee, are focused on:

The University’s approach to risk management is further described in the Statement of Internal Control in Section 5.8.

Finance and General Purposes Committee is responsible for monitoring and advising Council on the financial health of the University, including the financial strategy, budget setting, annual accounts, investment activity, and consideration of capital expenditure and estates development. The Committee also has responsibility for monitoring institutional level Key Performance Indicators (KPIs) in order to measure and monitor University performance against agreed strategies and targets.

Governance and Nominations Committee is responsible for a range of governance related issues including recommendations to Council on the appointment of new independent members and the spread of skills and experience of all Council Members. The Committee monitors and reviews the development and implementation of good governance practice, including oversight of the test to determine that Council Members are ‘fit and proper persons’ within the meaning defined by the Office for Students.

Remuneration and Human Resources Committee is responsible for the development of remuneration and reward policies for Senior Staff together with terms and conditions of employment for such staff, and for discussion of Human Resources Strategy for all staff. Further details are included in Section 4.2.

One of the recommendations of the GGI report, was that the status of the Council, Foundation, and Chaplaincy Committee (which oversees those aspects of the University’s mission and objects relating to its Anglican identity) should be revisited. Governance and Nominations Committee agreed that the group should become a liaison group and meet bi-annually.

In accordance with the Companies Act 2006 and Articles of Association, the Council is responsible for the administration and management of the affairs of the University and is required to present audited financial statements for each financial year.

The Council (of which are also the directors of the University for the purposes of company law) is responsible for preparing the Directors’ Report and the financial statements in accordance with applicable law and regulations.

Company law requires the Council to prepare financial statements for each financial year. Under that law, the Council is required to prepare the financial statements in accordance with United Kingdom Generally Accepted Accounting Practice (United Kingdom Accounting Standards and applicable law) including FRS 102 ‘The Financial Reporting Standard applicable in the UK and Republic of Ireland’. In addition, the Council is required to prepare the financial statements in accordance with the Office for Student (‘OfS’) Accounts Direction (issued October 2019), the OfS Terms and conditions of funding for higher education institutions (issued July 2024) and the terms and conditions of its the funding agreement with UK Research and Innovation (including Research England), the Education & Skills Funding Agency and the Department for Education through its accountable officer. Under company law, the Council must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the University and the Group and of the surplus or deficit, gains and losses, changes in reserves and cash flows of the University and the Group for that year.

In preparing the financial statements, the Council is required to:

The Council is responsible for keeping adequate accounting records that are sufficient to show and explain the University’s transactions and disclose with reasonable accuracy at any time the financial position of the University and enable it to ensure that the financial statements comply with the OfS Terms and conditions of funding for higher education institutions (issued July 2024), the Statement of Recommended Practice – Accounting for Further and Higher Education, 2019 Edition, the OfS Regulatory Advice 9: Accounts Direction (issued October 2019) and the Companies Act 2006. They are also responsible for safeguarding the assets of the University and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

The members of Council have taken reasonable steps to:

The Council is responsible for the maintenance and integrity of the corporate and financial information included on the University’s website. Legislation in the United Kingdom governing the preparation and dissemination of financial statements may differ from legislation in other jurisdictions.

The Council confirm that:

As the governing body of the University of Gloucestershire, the Council recognises that it has responsibility for maintaining a sound system of internal control that supports the achievement of policies, aims and objectives, whilst safeguarding the public and other funds and assets for which it is responsible, in accordance with the responsibilities assigned to Council in the Articles of Association and the expectations of the Office for Students as provided in the ‘Regulatory framework for higher education in England’.

The system of internal control is designed to manage rather than eliminate the risk of failure to achieve policies, aims and objectives. It can therefore only provide reasonable and not absolute assurance of effectiveness.

The system of internal control is based on an ongoing review process designed to identify the principal risks to the achievement of policies, aims and objectives, to evaluate the nature and extent of those risks, and to manage them efficiently, effectively and economically. This process has been in place for the year ended 31 July 2025 and up to the date of approval of the financial statements.

The University keeps its Risk Management Policy and Procedures under review in order to better recognise and manage the risks it faces in the delivery of its strategic aims. The risk framework is aligned with the University’s Strategic Plan. It has been designed to cover all risks including governance, management, quality, reputational and financial, whilst focusing on the most important risks. The risk register provides an appraisal of the current and projected position for each risk, including a likelihood/impact matrix. A detailed reporting schedule is in place to ensure that the relevant information is reviewed and reported in a timely manner to appropriate audiences including the University Leadership Group, Audit and Risk Committee, and Council. The University’s approach to risk management is periodically considered by the internal auditors, whose most recent review concluded that the controls upon which the University relies to manage risk are suitably designed, consistently applied and effective.

Risk management is fully incorporated into the corporate planning and decision-making processes of the institution and informs the work undertaken by Internal Audit. The University Leadership Group has a standing agenda item to review all key risks, to report on progress of action plans that introduce new mitigations, risk trajectories, and projected risk. While the identification of new and emerging risks may occur at any point during the year, an annual risk workshop is held at the start of the academic year to refresh the Risk Register. It has been embedded at school and department level by ensuring that the annual planning cycle includes a review of the risks facing each unit, together with clear mitigation plans, closely aligned with institutional level risks. Each School and Department has revised its own risk register to align with the institutional framework so that there is a clear link between the risks reported at an institutional level and at a school or departmental level. Detailed business continuity and disaster recovery plans, both at an institutional and a school or departmental level, are also in place.

In addition to this, Council oversees the University’s performance in meeting its strategic objectives through the approval and monitoring of the annual Strategy Delivery Plan. Regular updates on performance are presented to Council during the year in the Vice-Chancellors report to Council, and a year-end report considered in October.

The Council has responsibility for reviewing the effectiveness of the institution’s systems of internal control and, via the Audit and Risk Committee, conducts an annual review of these. Council considers the plans and strategic direction of the University and receives reports from the Chair of Audit and Risk Committee concerning internal control and has access to the minutes of Audit and Risk Committee meetings. The Audit and Risk Committee receives regular reports from the internal audit, which includes an independent opinion on the adequacy and effectiveness of the University’s system of internal control together with recommendations for improvement. The internal auditors’ annual opinion on the internal control environment is taken into account by Audit and Risk Committee in preparing its own opinion on internal control. The review of the effectiveness of the system of internal control is also informed by the work of the Executive Group within the University, who have responsibility for the development and maintenance of the internal control framework, and by comments made by the external auditors in their management letter and other reports.

In September 2018, the University successfully achieved registration with the Office for Students, without any specific conditions being applied to its registration. This registration has been maintained consistently since.

Council is of the view that the University has an appropriate framework for delivering assurance to the governing body on key aspects of governance, risk management and internal control, and that there is clarity in terms of the respective roles of the Audit and Risk Committee, Finance and General Purposes Committee and Council and how internal audit interfaces with these bodies.

The Council Members of the university consider, both individually and together, that they have acted in the way they consider, in good faith, would be most likely to promote the success of the University (having regard to the stakeholders and matters set out in s172 (1) (a-f) of the Act) in the decisions taken during the year ended 31 July 2025.

The success of the University is reliant on the support of all of our stakeholders. It is important to us that we build positive relationships with stakeholders that share our values, and working together towards shared goals assists us in delivering long-term sustainable success.

Consequences of any decision in the long term

The Council understands the importance of considering both the short-term and long-term goals as well as the risks that may be encountered to achieve these.

To support these considerations, the University prepared a Finance Strategy for 2022-2025 and a Strategic Plan for 2022- 2027. Additional information on these, along with consideration of the specific risks the university is managing can be found within Section 1.7 of our Operating and Financial Review.

Employees

Our people are key to our success and we want them to be successful individually and as a team. There are many ways we engage with and listen to our people including staff engagement surveys, regular updates from the Vice-Chancellor through termly all staff briefings, coffee catch ups and fortnightly leadership blogs. We have also set up a Women’s network, a Pride network a Global Majority and Neuro Diverse network in addition to the Equality, Diversity and Inclusion Committee. The University’s EDI policy relates to all staff and students, and protected characteristics. The University is a Disability Confident Leader, we guarantee an interview to any applicant with a disability who has met the essential criteria and we proactively implement reasonable adjustments to support candidates and employees. It is important to us that all our staff members feel fully supported and we provide them with access to an Employee Assistance Programme which offers confidential support for any issues they may encounter.

Business relationships: Students

Students are the key to everything we do. Our new strategic plan for the period 2022-2027 focuses several of its goals on students and the service/support that they need. In particular, three of the University’s strategic goals are to provide an outstanding quality of education, support for student wellbeing, and the promotion of career success. Students are able to meet with the Student Union on a monthly basis and there are termly ‘Voice it to the VC’ sessions which help provide the support students need.

Suppliers

It is important for the university to obtain the best terms and best value for all of its business activities and the Council recognises that relationships with suppliers are important to long-term success and as such we work to build strong relationships to develop mutually beneficial and lasting partnerships.

Impact on communities and the environment

As mentioned within our Operating and Financial Review, one of our key strategic priorities is to build partnerships which create opportunity, innovation and mutual benefit for the communities we serve. The University continues to engage with its very local communities through facilitating ‘Community Liaison Groups’ linked with each of its campus sites, as well as the Pittville Student Village.

Our annual BSI ISO14001 external reassessment audit of our Environmental Management System took place in June 2023 and resulted in a successful outcome. The auditors recommended to the British Standards Institute that the University be re-certified for the period September 2023 to September 2026.

Maintaining high standard of business conduct

It is important for the University to comply with relevant laws and regulations, including the specific expectations of the Office for Students, the regulator for providers of higher education in England, as well as statutory matters including health and safety. The Council is updated regularly on legal and regulatory developments and takes these into account when considering future plans.

The University conducts its business in accordance with the seven principles identified by the Committee on Standards in Public Life (selflessness, integrity, objectivity, accountability, openness, honesty and leadership) and ensures all members of the Executive and Council meet the definition of the Office for Students of a ‘fit and proper’ person. Further details on this and the other ways in which the University ensures it maintains a high standard of business conduct can be found within Section 7 ‘Corporate Governance’ of our Operating and Financial Review.

The Operating and Financial Review and the S172 Statement of Council Members set out on this webpage was approved by the Council of the University of Gloucestershire on 25 November 2025, and was signed on its behalf by:

Nicola de Iongh

Chair of Council

Clare Marchant

Vice-Chancellor and Chief Executive

We have audited the financial statements of the University of Gloucestershire (the ‘parent University’) and its subsidiaries (the ‘group’) for the year ended 31 July 2025, which comprise Consolidated and University Statement of Comprehensive Income and Expenditure, Consolidated and University Statement of Changes in Reserves, Consolidated and University Balance Sheet, Consolidated and University Cash Flow and notes to the financial statements, including a summary of significant accounting policies. The financial reporting framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards, including Financial Reporting Standard 102 ‘The Financial Reporting Standard applicable in the UK and Republic of Ireland’ (United Kingdom Generally Accepted Accounting Practice).

In our opinion, the financial statements:

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the ‘Auditor’s responsibilities for the audit of the financial statements’ section of our report. We are independent of the group and the parent University in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.